Find the Best Resources to Grow Your Business

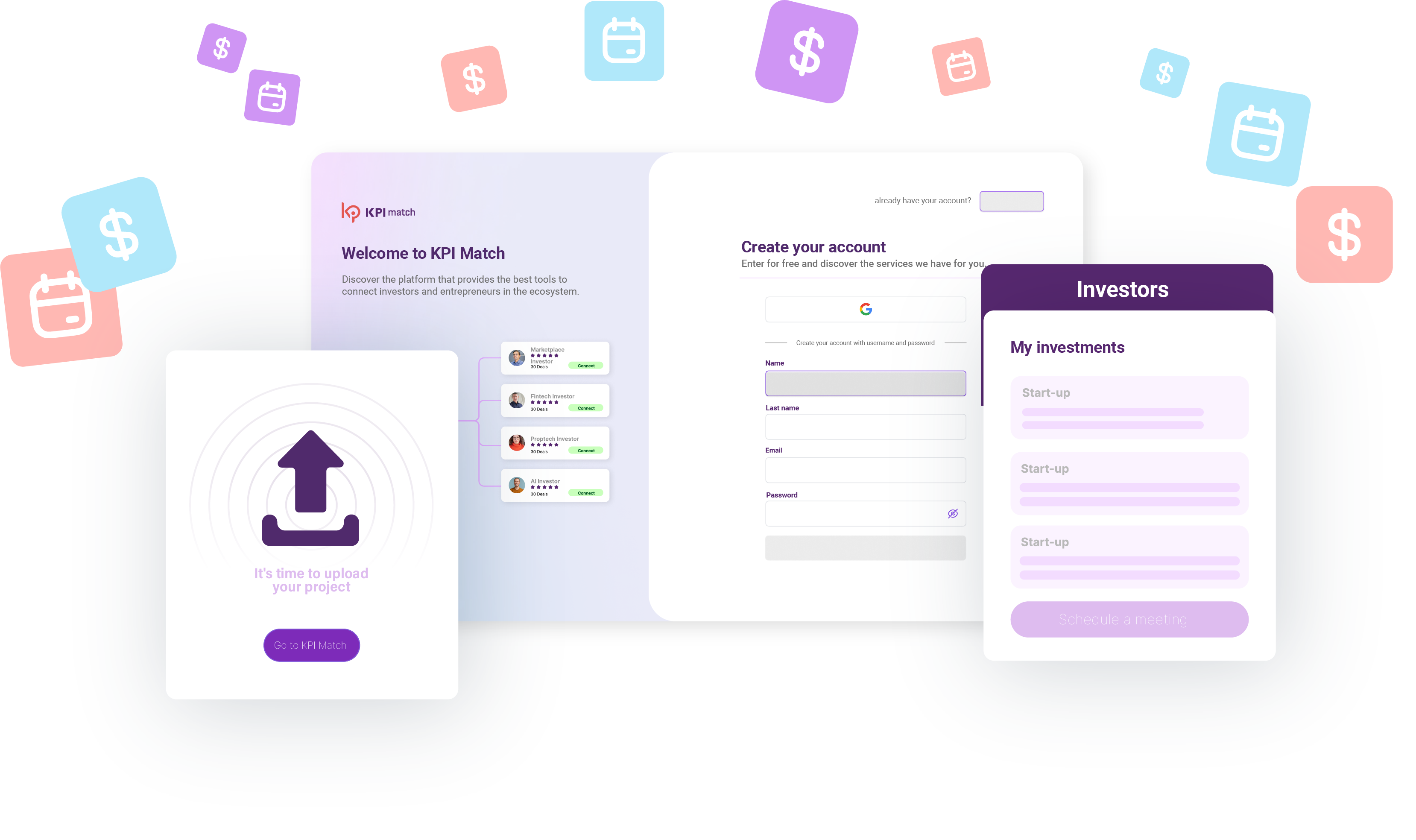

Strengthen your business with essential tools. At KPI Match®, you’ll get several of them for free to help your project grow successfully

Free Resources

Discover our free resources, carefully designed to support your entrepreneurial journey.

Courses and Events

Explore courses and events designed to enhance your business growth.

Frequently Asked Questions

Have questions? Don’t worry! Here, you’ll find answers to the most common inquiries.

Free Resources

Discover our free resources designed to support your entrepreneurial journey.

Community

Join our vibrant community of passionate professionals and entrepreneurs.

Courses and Events

Explore our courses and events here.

Frequently Asked Questions

Have questions? Don’t worry! Find answers to the most common inquiries here.

Community

Courses and Events

5 Tips to Present Yourself to Investors

5 Tips to Improve Your Presentation

Frequently Asked Questions

With over seven years of experience advising on financial and legal processes for companies at various stages, we’ve compiled some of the most common questions we receive about investment rounds:

An investment round is a process in which a project/company seeks to raise financing through the private sale of shares to interested investors. However, there are other forms of financing as well, such as debt or hybrid models, which can be used to achieve the expected growth goals and which can be negotiated during the investment round.

The ideal time to pursue an investment round is not rigid, but it is generally recommended to seek investment when the business model has demonstrated solid results and maturity in terms of traction and market validation. It is also important that the company operates in a growing market and has an experienced team in place to execute the business.

This amount depends on your company’s specific goals and needs. A detailed financial analysis and strategic planning can help determine the amount needed and define the size of your investment round. It is recommended to include an additional value for contingencies not contemplated in the financial projections. For example, if your round estimate is USD50K, you can start the round with USD55-60K.

Angel investors, venture capital investment funds (VCs), family offices, institutional investors, corporate investors, among others, can participate.

Valuation is determined through negotiations between the company and interested investors. At KPI, we have several valuation methodologies to help you prepare for your investment round. This implies that the conversation begins with a figure on the table.

The time can vary from initial preparation to investment closing, but on average it is 4-6 months. This period includes investor presentations, negotiations and due diligence. Therefore, KPI Match® decreases this time by connecting directly with the right investor.

The ownership structure may change as new investors acquire a stake in the company. It is essential to agree on clear terms in order to ensure an adequate transition and entry of the new partner. At KPI, we will assist you in structuring the most appropriate entry.

Investors are generally looking for detailed information about the business model, financial statements, company valuation, growth strategy and management team. For this reason, it is important that you prepare this important information before starting your investment round, KPI Match® will help you with this preparation.